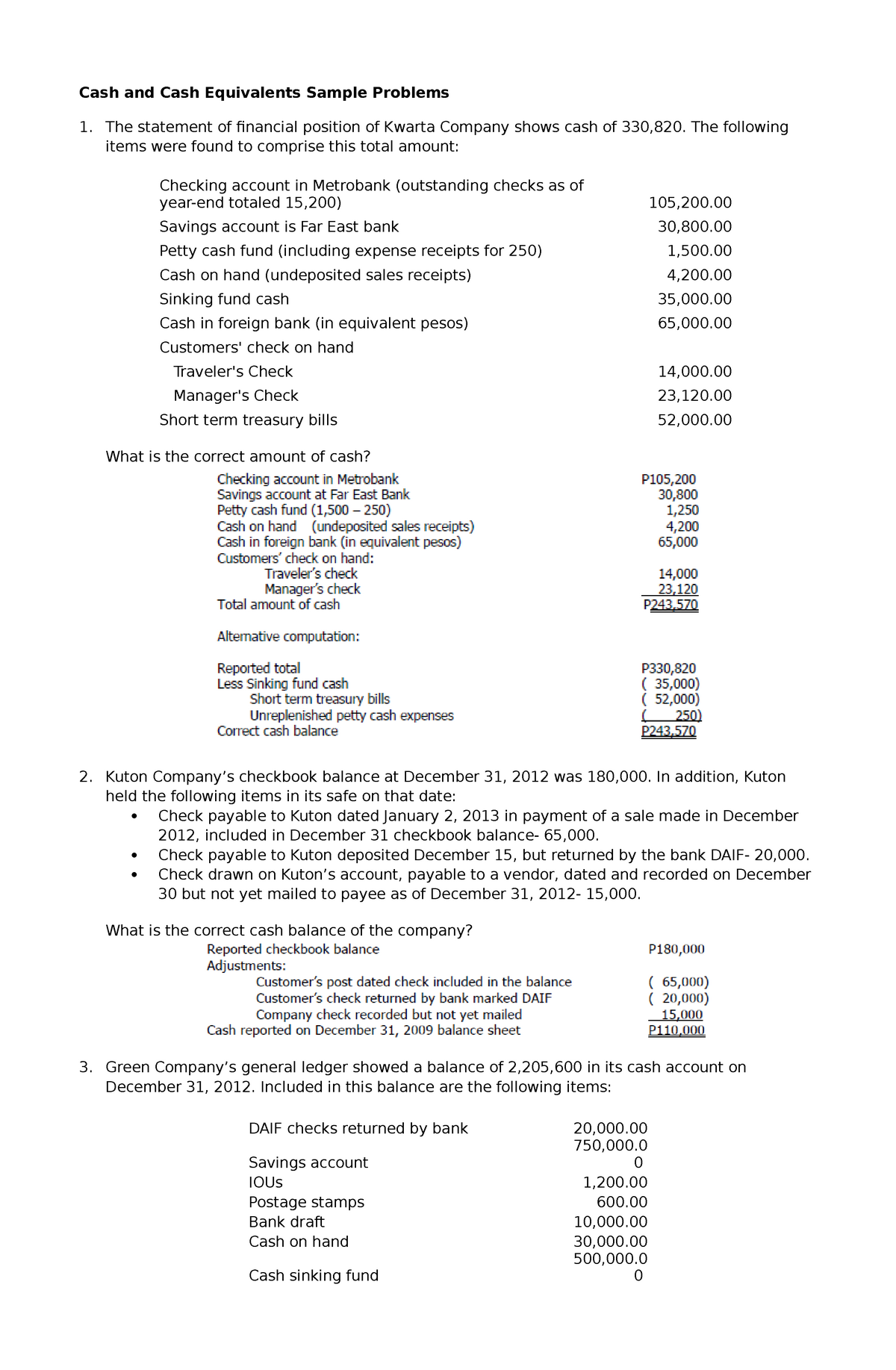

- An enormous down-payment: Of many lenders will need a deposit regarding 20%, though it could be you can easily to put off just 10%. If you wish to put down a tiny downpayment, the borrowing from the bank, earnings and cash reserves will likely need to be even higher.

Loan providers were choosy for the individuals they accept for jumbo finance, when you want to make sure your qualify, it is possible to run gathering their borrowing from the bank and you may assets.

A beneficial jumbo mortgage isnt readily available for someone to buy even more household than capable relatively afford. Jumbo mortgages try of these homebuyers who are economically safe and you will want to purchase property that is more costly compared to the average property. You can search within the limits to the conforming financing on your urban area to decide if your dream house exceeds the latest limit, just in case it can, you may want to explore obtaining good jumbo financial.

Jumbo mortgages is great for young benefits starting off in the their work that happen to be generating a premier paycheck, however, exactly who perhaps do not have tall info gathered just yet. When you’re a high-income earner while making $250,000 so you’re able to $five-hundred,000 per year, and you’re looking to purchase a pricey household, a beneficial jumbo mortgage might possibly be a great option for you.

What is a conforming Financing?

Conforming finance get their term as they follow the variables lay from the Freddie Mac computer and you may Fannie mae. Financing terms were sensible, pricing and you will qualification to possess compliant money are standardized, and you may interest levels will be less than low-compliant financing. A compliant financing is also titled a traditional financing and that’s the most famous brand of mortgage.

step one. How does a compliant Mortgage Really works?

As compliant funds pursue Fannie mae and Freddie Mac assistance, he or she is extensively recognized of the lenders and financial issuers. Funds one to follow requirements are easier to promote and buy.

Just what all of the compliant financing have commonly try their needs to own a downpayment, credit rating, financing maximum and you can loans-to-money proportion. Conforming financing commonly backed by bodies providers, thus FHA loans, USDA fund and you may Virtual assistant financing commonly sensed conforming finance, since they’re all backed by government entities.

Compliant mortgages come with financing restrictions. For one-unit features, brand new 2019 restrict are $484,350 for the majority of the nation, but from inside the areas with competitive property areas, and this, high home prices. Regardless, you will find nevertheless a limit to possess competitive avenues, that is 150% more than the bottom restrict. https://paydayloanalabama.com/decatur/ Currently, so it natural maximum is $726,525.

The degree of interest you can easily shell out on your own conforming loan depends for the interest rate your and obtain and also the period of your own loan identity. Eg, you might choose from a thirty-12 months or fifteen-year mortgage. For a 30-12 months mortgage, you are able to spend way more interest, but your monthly payments might also be less than which have an excellent 15-12 months mortgage.

If you cannot set no less than 20% off, you will likely have to pay personal home loan insurance fees. PMI handles the lending company if you cannot create your mortgage repayments, but it insurance rates will not include you, the brand new debtor.

dos. Could you Re-finance a good Jumbo Financing To your a compliant Mortgage?

If you have safeguarded a great jumbo loan, you may be questioning if you can re-finance the loan to the a conforming mortgage. Though it can be done, refinancing should be a problem. According to your position, it can be worth the energy in the event it form larger deals by reducing the monthly payments along with your rate of interest.

- A great FICO get with a minimum of 660

- A financial obligation-to-income ratio lower than 43%